[ad_1]

Stock market behavior forecasting is a crucial undertaking that requires careful attention since, with the right choices, a successful prediction of stock prices might result in attractive gains. Due to non-stationary, noisy, inter-dependence, and chaotic data, stock market forecasting is a significant challenge, making it difficult for investors to spend their money in a way that would result in profits. Given the importance of this area, machine learning experts have proposed several models that aim to predict the future value of stock market groups.

The earlier works used traditional machine learning techniques such as support vector regression, random forests, and the bayesian model. More recently, researchers have turned to deep learning models. Deep neural networks such as LSTM and encoder-decoder are increasingly used to perform the task of stock market prediction since they are more efficient in facing the time-series nature of the data.

StockBot, a new approach proposed by researchers from Stanford University, was introduced to help investors make a daily decision: sell or buy. It is a generalizable price predicting model based on stacked LSTM aiming to predict stock prices for new stocks that do not have sufficient historical data.

Generally, LSTM-based prediction models are trained on the price of a single stock and can perform only the inference using the parameters learned on the same stock. Therefore, the authors proposed to train the network specifically to an industry type such as “energy” or “finance.” Concretely, past and future prices from multiple tickers in the same industry are combined to create a mixed training and/or test set. In this way, the model can operate in two modes. Although the training step is made using the combined set, the prediction step can be done for all the tickers or just for a single one which is very useful for performing a more robust prediction for stocks with insufficient historical data. In addition, a bot is used to perform the buy or sell operations at the time of closing every day in order to maximize gains. The decision is made by use of the predictions of the stock prices analytically without any training phase. The algorithm followed by the bot is as follows:

1) Calculate the δi changes given by δi = sign(ci+1 − ci), where ci is the stock price on the ith day.

2) check the evolutions of the δi, by following ∆i = δi+1 − δi.

The decision is made regarding the value of ∆. When ∆ = −2, the bot decides to buy since it indicates the end of a trough. While ∆i = 2 indicates the beginning of a dip, the bot decides to sell.

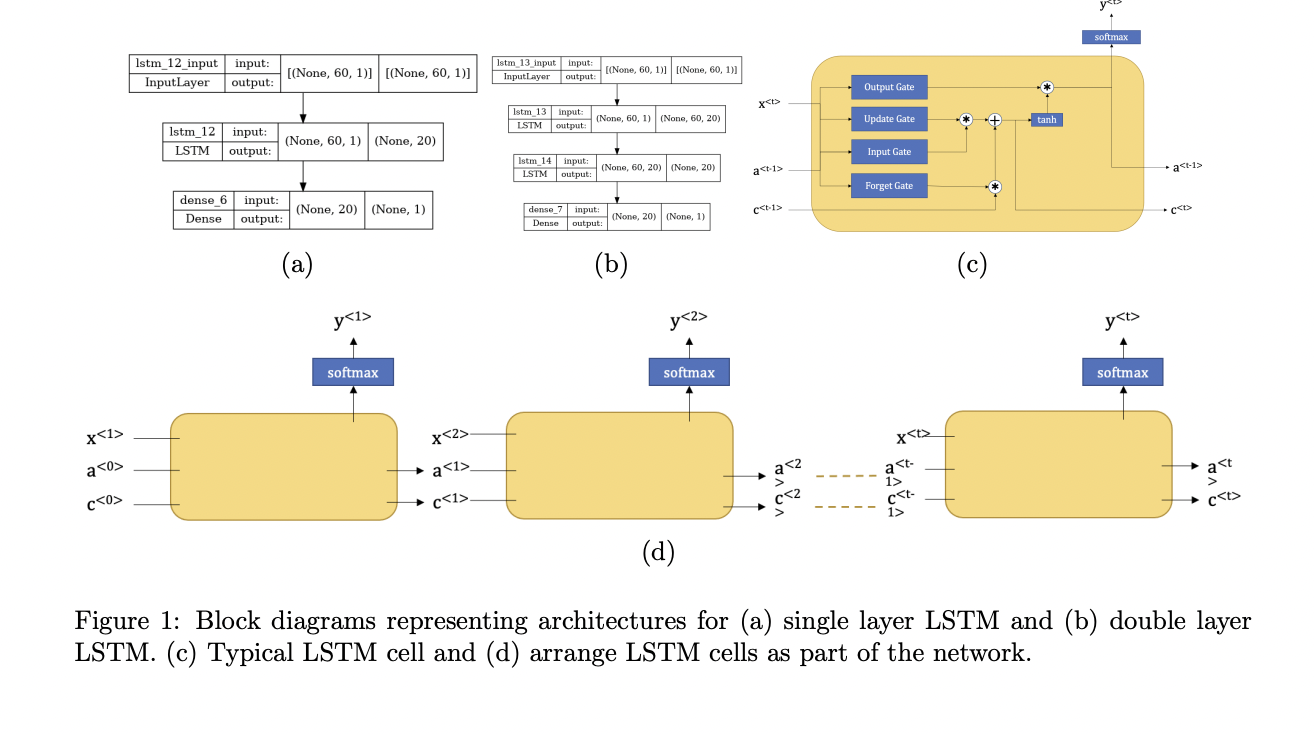

The authors explored several possibilities in the experimental study by comparing different prediction models such as single/stacked many-to-one LSTM architectures and the Encoder-Decoder model. Results demonstrate that the single/double-stacked LSTMs are the best architectures. In addition, for simplicity and speed, the prediction of multiple days together has proven to be more interesting than predicting the future day one at a time since the latter approach can only predict one day at a time. Finally, the decisions taken by the bot surpass even the most aggressive ETFs and the main investment products provided by investment firms.

We have seen in this article a new model of stock market prediction which allows benefiting from two major advantages: firstly, to predict stocks which suffers from a limited database thanks to a network trained on several other firms belonging to the same sector of activity. Second, benefit from decision support thanks to a bot that knows when to buy or sell according to daily changes in predicted closing values.

This Article is written as a research summary article by Marktechpost Staff based on the research article 'StockBot: Using LSTMs to Predict Stock Prices'. All Credit For This Research Goes To Researchers on This Project. Checkout the paper, gitlab link. Please Don't Forget To Join Our ML Subreddit

![]()

Mahmoud is a PhD researcher in machine learning. He also holds a

bachelor’s degree in physical science and a master’s degree in

telecommunications and networking systems. His current areas of

research concern computer vision, stock market prediction and deep

learning. He produced several scientific articles about person re-

identification and the study of the robustness and stability of deep

networks.

[ad_2]

Source link