[ad_1]

R&A Studio

This article was published on Dividend Kings on Wednesday, June 7th.

—————————————————————————————

Artificial intelligence, or AI, has become the latest mania on Wall Street.

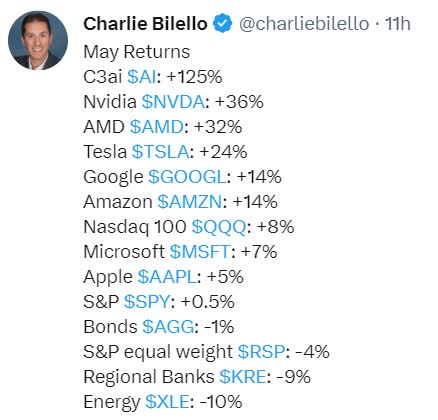

Charlie Bilello

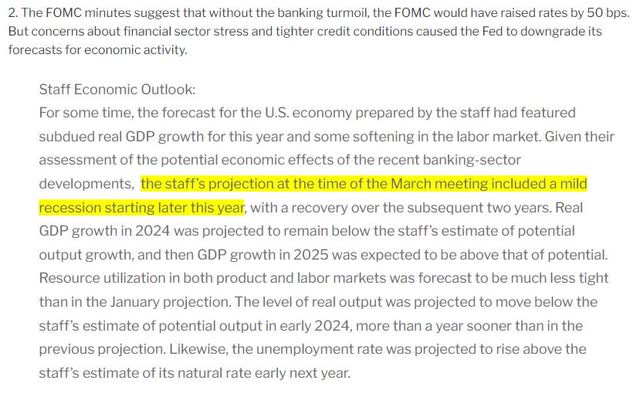

In May alone, AI stocks saw the kind of rally we only see in bubbles like the dot-com bubble and the Pandemic “free money forever” bubble.

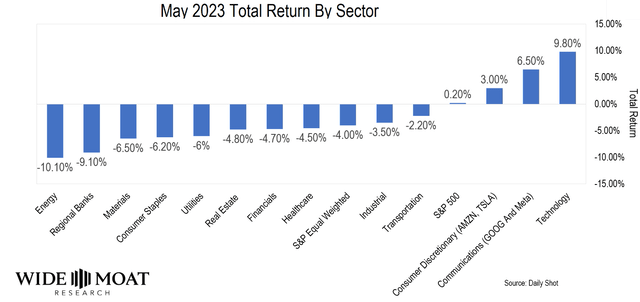

Wide Moat Research

But in reality, May was a bad to terrible month for stocks, with the Invesco S&P 500® Equal Weight ETF (RSP) falling 4% and all sectors other than tech suffering large to very large declines.

Why? Because we’re in a stealth recession right now or very shortly will be in a recession.

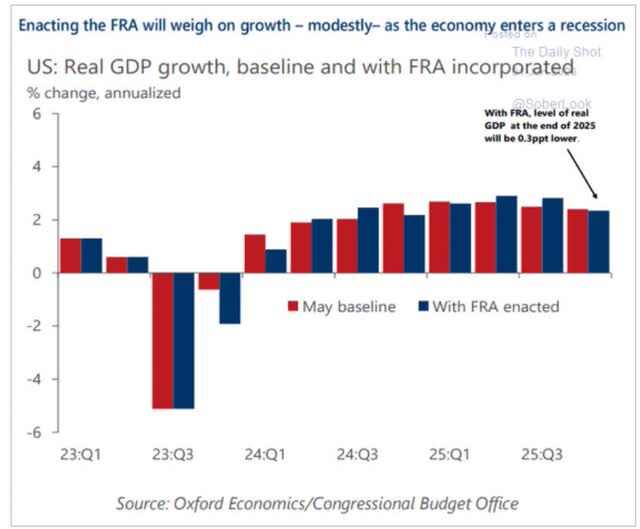

Daily Shot

Oxford Economics estimates a peak GDP decline of 1.7%, slightly above the average recession since WWII of 1.4%.

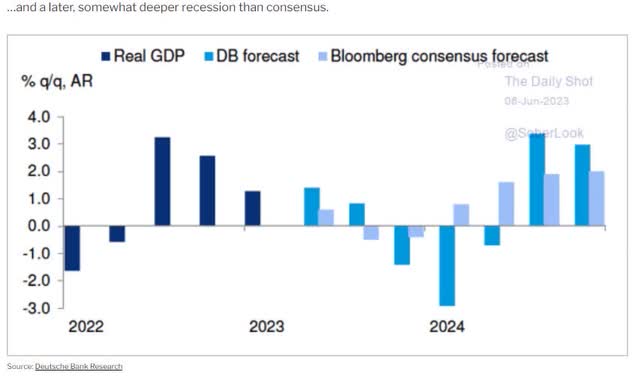

Daily Shot

The Bloomberg consensus expects a peak decline of 0.5%, the mildest recession in history.

The FactSet consensus is for a -0.5% contraction as well.

Deutsche Bank expects a 6% peak GDP recession, 50% worse than the Great Recession.

The bond market puts the odds of a recession by October 31st, 2024, at 100%.

Daily Shot

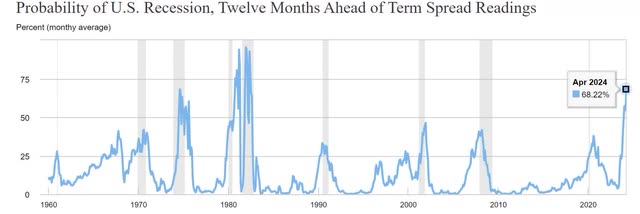

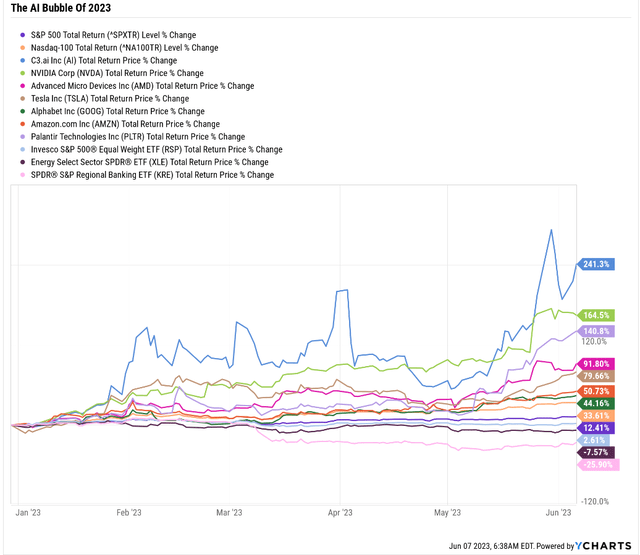

According to Fed minutes, the Fed’s own economists expect a mild recession this year.

NY Fed

And the NY Fed estimates the risk of recession in the next year to be the highest in 42 years.

Copper, the world’s most used industrial metal, fell 4% in May, meaning “Dr. Copper” is very worried about a recession.

Daily Shot

In fact, the copper-to-gold ratio is signaling that 10-year yields (US10Y) could fall to 1.5% in the coming downturn and 30-year yields about 1.75%.

- A potential 43.4% rally in long-duration U.S. treasuries.

Saudi Arabia just unilaterally cut oil production by 1 million bpd over concerns that oil prices could fall significantly in the coming recession.

And yet, this is happening.

Ycharts

AI big tech is partying like it’s 1999. Cyclical hyper-volatile chip stocks like Nvidia Corporation (NVDA), whose average bear market is a 54% crash (median 58% crash), are acting as if there were recession-proof low volatility defensive dividend aristocrats.

In fact, some of these AI stocks are acting as if they are as defensive as bonds in a recession!

NVIDIA Is NOT A Bond Alternative

| Bear Market | Nvidia | 60/40 | S&P |

| 2022 Stagflation | -63% | -21% | -28% |

| Pandemic Crash | -2% | -13% | -34% |

| 2018 Recession Scare | -52% | -9% | -21% |

| 2011 Debt Ceiling Crisis | -38% | -16% | -22% |

| Great Recession | -79% | -44% | -58% |

| Tech Crash | -87% | -22% | -50% |

| Average | -54% | -21% | -34% |

| Median | -58% | -19% | -31% |

(Source: Portfolio Visualizer Premium.)

Only in an insane world would I have to point out that Nvidia is not a bond alternative in a recession, but that’s the world we apparently live in.

FAST Graphs, FactSet

Only in an insane world do I have to explain that “This time is different. No price too high to pay for AI” is a very bad investment “strategy” that will eventually lead to tears.

Yet that’s the world we live in.

But we also live in a world that AI will likely transform, and long-term investors need to know reasonable and prudent ways to profit from it.

So that brings me to Microsoft Corporation (NASDAQ:MSFT) and the 1.3 trillion reasons why this is as close to a must-own world-beater AI dividend blue-chip.

The $1.3 Trillion Promise Of AI

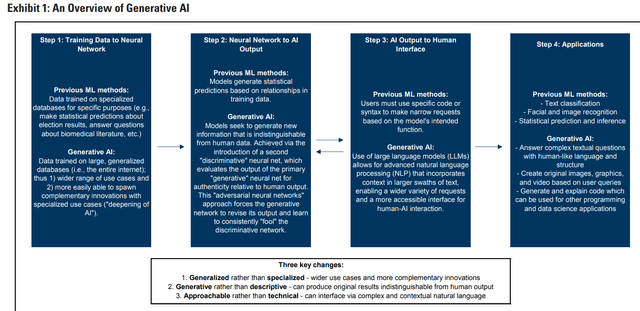

What is this AI that has taken Wall Street by storm?

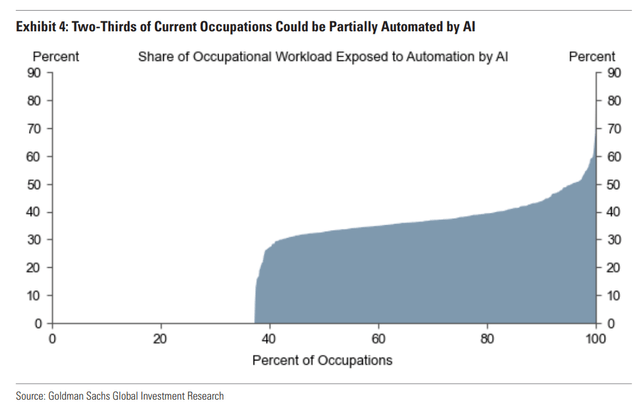

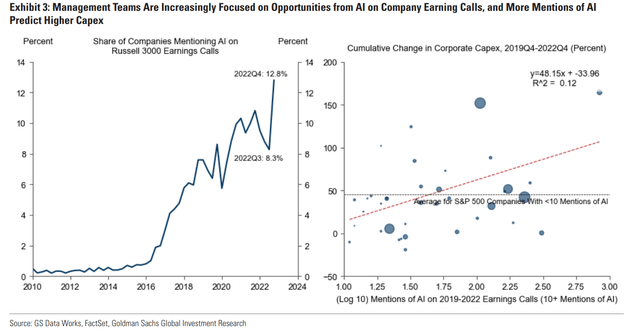

Goldman Sachs

It’s potentially the next industrial revolution and brings both the threat of extinction but also a post-scarcity Star Trek Utopia.

- The choice is ours; which path do we choose.

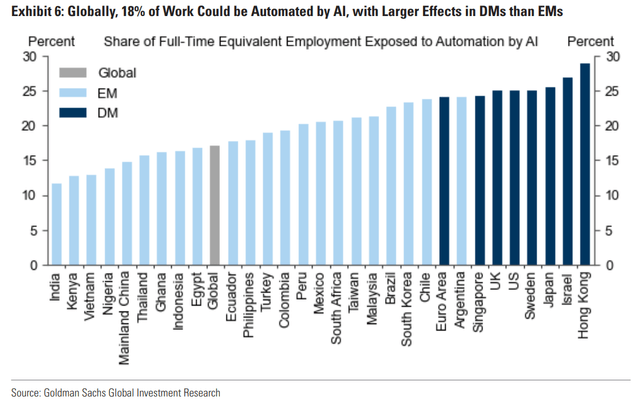

Goldman Sachs

2/3rd of workers could eventually be using AI in their jobs.

Goldman Sachs

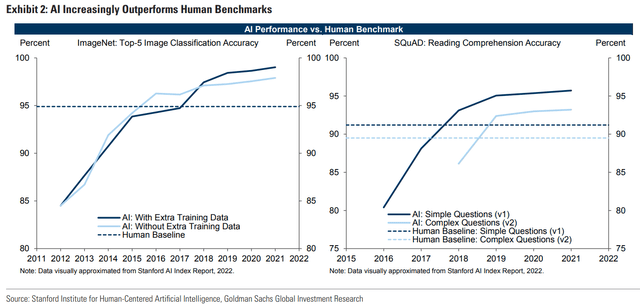

AI can do data analytics faster and better than humans.

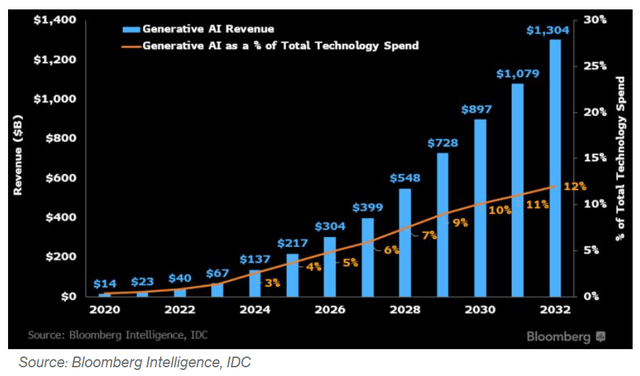

Bloomberg

Bloomberg Intelligence estimates that the generative AI market is growing at 42% and could hit $1.3 trillion by 2032.

According to Bloomberg Intelligence’s forecasts, the largest driver of revenue growth from generative AI will come from demand for the infrastructure needed to train AI models, amounting to an estimated $247 billion by 2032. The report said the AI-assisted digital ads business is expected to reach $192 billion in annual revenue by 2032, and revenue from AI servers could hit $134 billion.” – Bloomberg (emphasis added).

Do you know what AI infrastructure means? Cloud computing.

AI servers? Data centers.

And digital advertising is going to be dominated by whoever has the most data and most effective ads today.

But as exciting as a $1.3 trillion per year addressable market might be, the economic implications of AI are far larger.

The Potential For AI To Reshape The Economy

A study from the National Bureau of Economic Research about ChatGPT’s impact on worker productivity at call centers found a 14% boost.

A Stanford and MIT study also found a 14% boost in worker productivity. But that was just the average worker.

“[T]he improvement was even more pronounced for “novice and low-skilled workers” who were able to get their work done 35% faster.” – CNBC.

AI could literally close the income gap and all those job losses we worry about. The 55-year-old trucker who can’t retrain into a new career? Well, apparently, ChatGPT can help them after all.

Where one doctor with 12 years of training could oversee maybe ten patients, now one doctor can oversee 10 Nurse practitioners (who have Masters degrees) whose skills and knowledge are enhanced by Generative AI.

Think I’m exaggerating?

Customer service agents with two months of experience who used AI support performed as well or better than agents with over six months of experience working without AI…

Meanwhile, the use of AI tools showed a minimal impact on “experienced or highly skilled workers,” the authors note, and at times served as a distraction.” – CNBC.

It’s going to take time for experts to figure out how to harness this incredible new tool, but lower-skilled workers are already benefiting to an immense degree.

What about the AI dystopia that so many fear? A maximum productivity hellscape where we’re all slaves to the machines?

The year-long experiment also revealed that AI assistance improved customer satisfaction, reduced requests for managerial intervention and improved employee retention.” CNBC

That doesn’t mean we’re not looking at some job losses.

“Professionals who can adeptly harness the capabilities of large language models, such as OpenAI’s GPT-4, will undoubtedly gain a competitive advantage over those who do not embrace these cutting-edge advancements,” says Egor Nazarov, chief marketing officer at Soter Analytics. “Progressive organizations will leverage AI to unlock their workforce’s full potential, whereas regressive companies may choose to eliminate positions in response to automation.” – Forbes.

But, AI has been pointing more toward utopia than dystopia so far.

The research isn’t meant to hypothesize whether AI will replace workers, Raymond says, but rather concludes the technology will help workers more effectively multitask and handle more complicated questions faster.” – CNBC (emphasis added).

Do you know what my biggest fear about AI is? No, it’s the Terminator scenario.

It’s not that I’m going to lose my job (I’m an entrepreneur and my own boss).

It’s that AI is going to save us so much time that our companies will be free to trap us in meeting hell. 😉

- I have eight meetings this week alone!

- Stop the madness!

- Save us ChatGPT. You’re our only hope. 😉

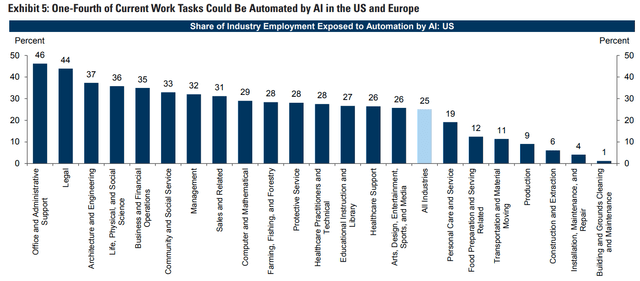

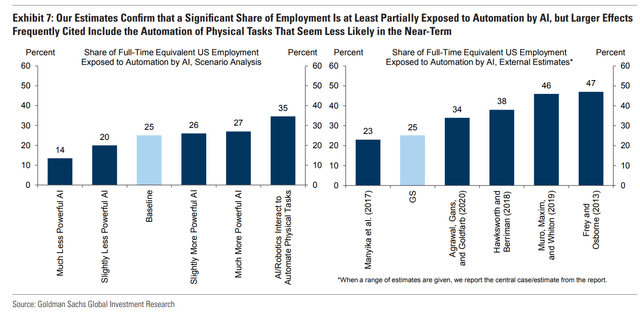

Goldman Sachs

Tasks are not jobs; they are usually the BS we have to do as part of our work that few people enjoy. AI has the potential to automate paperwork.

Do you think anyone rues the spreadsheet’s rise because it made manual mathematical calculations unnecessary?

Rooms used to be filled with people (mostly women) who would manually crunch numbers for companies. Now that number crunching is done via spreadsheet. Society, including women, are better off as a result.

Goldman Sachs

The pessimists hear “work could be automated” and hear “all jobs will be permanently lost.”

In reality, humans are incredibly innovative, creative, and adaptable. We’ve survived and thrived in every climate on earth, from the active’s frozen wastes to the Kalahari’s scorching desserts.

And we’ll find ways to harness AI to make our lives better. Or will I wind up too dead to care that I was wrong. 😉

Goldman Sachs

Even full AI + robotics doesn’t threaten the majority of jobs.

Goldman Sachs

It’s the lawyers that have the most to fear from AI. And I doubt most of us are shedding a tear over that. 😉

Goldman Sachs

Better and faster work led to happier customers, who were, in turn nicer to customer service agents and improved employee retention, Raymond says…

She adds that tools that make people more effective at their jobs make the experience of work less stressful…

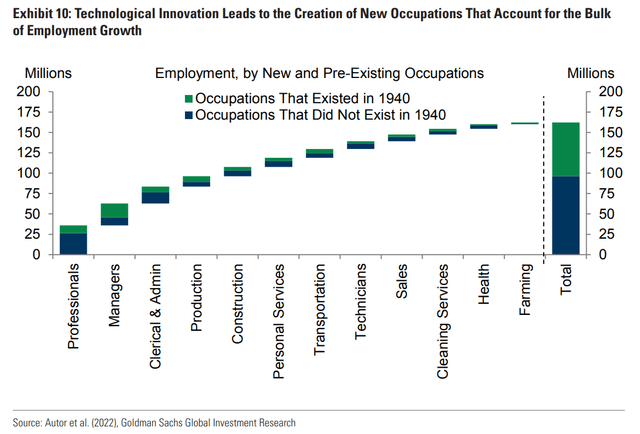

Workers who work with generative AI will replace those who don’t.” – CNBC.

When ATMs were introduced in the 1980s, bank tellers feared for their jobs.

There were 472,000 bank tellers in 2018, an over 10 percent increase since 2000. In fact, the number of bank tellers today is only slightly less than the number in 1990 or 1890.” – Brookings.

Today’s bank tellers no longer spend their time dispensing cash; they talk with customers and try to sell them various bank solutions. The average bank teller makes more than before ATMs and has a better, more satisfying job.

Those who refuse to learn how to use AI? What of the engineers who refused to learn how to use calculators, spreadsheets, and computer-aided design because they were used to slide rules and graphing paper?

Those engineers no longer have jobs, but society has far better and more efficient engineers now.

One recent survey of LinkedIn’s Top Companies found that nearly 70% say AI is already helping them be faster and smarter, and another 32% say they expect to see larger gains from using AI in the coming years. And companies like EY explicitly listed AI as one of their top three hiring priorities, while Wells Fargo and Kaiser Permanente are implementing AI across their workflows.” – CNBC.

This isn’t blockchain, Web3, NFTs, or metaverse hype. This is real, people.

Goldman Sachs

Seeking Alpha is now autogenerating summary bullets with ChatGPT 4!

- We have the ability to adjust them manually.

Results that generative AI can boost productivity is generally good news, though the biggest benefits may not be evenly distributed, says Erik Brynjolfsson, the director of the Digital Economy Lab at the Stanford Institute for Human-Centered AI and co-author of the report. “There’s no guarantee we’ll all benefit, but it certainly sets the table for us all being better off,” he says.” – CNBC.

The distribution of AI benefits, like the distribution of all economic benefits from new technology, will be an issue.

No one wants a world in which Mark Zuckerberg has somehow taken over AI and is has all the money. 😉

But growing the economic pie is the essence of human progress. It’s the easiest and best way to solve our deficit, fiscal, and even social problems.

And let me show you what I mean.

AI: Bringing Hope To A “Hopeless” World

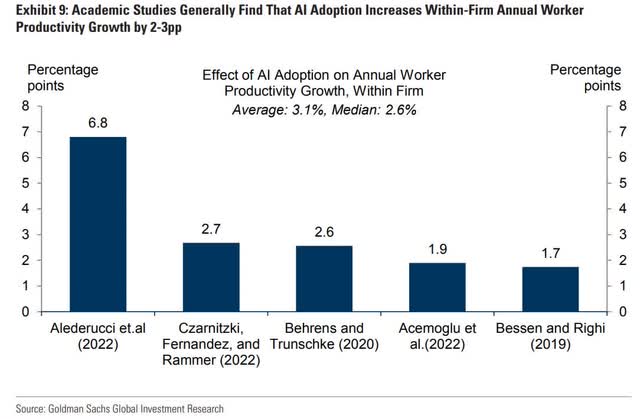

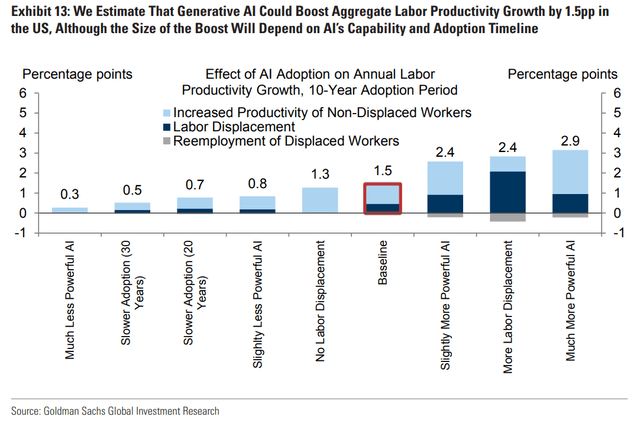

We estimate that generative AI could raise annual US labor productivity growth by just under 1½pp over a 10-year period following widespread adoption.” – Goldman Sachs.

Productivity is the most important component of economic growth and rising standards of living. Real wages track productivity over time.

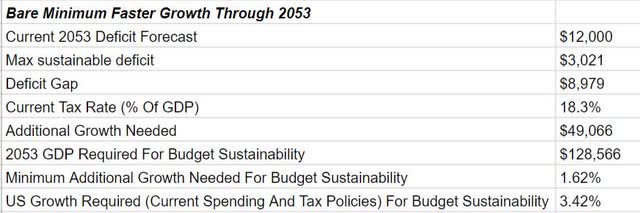

According to the Congressional Budget, if the U.S. could boost its annual growth rate by 1.6% yearly, we would solve our long-term deficit problem.

Congressional Budget Office

Or, to put it another way, if the U.S. were to grow 3.4% per year through 2053, then Republicans could keep their tax cuts, and Democrats could keep their spending plans as is.

We’d prevent a long-term debt doomsday without anyone’s sacred cows getting gored.

| Policy | Potential GDP Growth Boost |

| Lead Removal | 0.4% |

| Pro Fertility/Family Policy (2.7 children per family) | 0.7% |

| Human Capital Investment | 0.8% |

| Artificial Intelligence | 1.5% |

| Infrastructure Repair | 1.6% |

| Immigration (1900 to 1915 rate) | 1.9% |

| R&D (1950’s rate) | 2.5% |

| Infrastructure Improvement (Energy Transition) | 2.6% |

| Long-Term Base-Case (Current Policies) | 1.8% |

| Max American Economic Growth Potential | 13.8% |

|

Sources: Moody’s, Bloomberg, Federal Reserve, National Bureau Of Economic Research, National Institute Of Health, CDC, Goldman Sachs, ASCE |

Well, guess what? Goldman thinks that AI alone could potentially get us 94% of the way to deficit sustainability.

Goldman Sachs

And Goldman’s 1.5% productivity boost might be conservative. The median boost in productivity and, thus growth from academic studies is 2.6%, with an average of 3.1%.

Add in even a fraction of the infrastructure spending we need, and BOOM, the deficit crisis is solved.

Goldman Sachs

The timing of the productivity boom is uncertain, but it’s likely coming, and when it does, it could create a golden age for investors.

What AI Could Mean For The Stock Market

Goldman Sachs

Goldman’s baseline scenario is a 1.5% boost in production and GDP growth, translating to 2.7% faster earnings growth.

Bank of America estimates that each 1% growth in GDP translates to 4% faster corporate earnings growth.

So that means under Goldman’s baseline scenario, S&P corporate earnings could grow about 11.2% annually, combined with a 1.7% yield equals 12.9% long-term stock returns.

If Bank of America is right, then corporate earnings could grow 14.5% and drive 16.2% long-term stock returns.

And in the best case scenario, 2.9% productivity growth drives 2.9% faster economic growth (4.7% US GDP growth), which could mean an 11.7% EPS boost for corporate America, on top of the 8.5% FactSet consensus or 20.2% earnings growth and 21.9% long-term returns.

Warren Buffett’s non-leveraged returns have been 12.8% over the last 58 years. His actual returns were 20%.

AI literally could make it so that anyone owning the S&P 500 (SP500) could enjoy Buffett-like long-term returns.

Not due to some Fed money printing bubble, not due to outrageous government spending, not due to some silly mania, but purely driven by fundamentals.

Worst Case Scenario: Weak AI drives “just” a 0.3% productivity boost resulting in 0.5% faster EPS growth and 8.7% long-term stock growth.

- Deutsche Bank has the lowest long-term S&P EPS growth forecast at 6.5%

Base-case scenario: 1.5% boost to productivity, driving 2.7% faster EPS growth and 12.9% long-term stock returns.

Best-case scenario: 2.9% productivity boost driving 11.7% faster EPS growth and 21.9% long-term stock returns.

I don’t know about you, but I’m really excited by the idea of AI solving the deficit problem, boosting the economy so much that we can afford to fix all our fiscal problems, workers benefiting from less crappy jobs, making more money, AND the stock market partying like its 1999… but without a bubble.

Why Microsoft Is As Close To A Must-Own AI Blue-Chip As Exists

OK, so now that you understand the world-changing potential of AI, here’s why Microsoft is one of my favorite long-term AI “plays.”

It all stems from two key facts.

Microsoft Azure, its cloud computing platform, is growing like a weed.

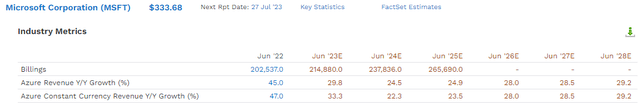

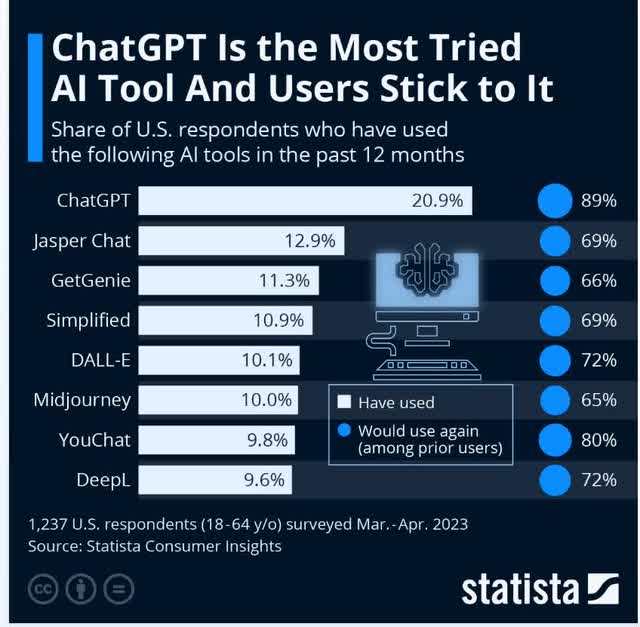

FactSet Research Terminal

Through at least 2028, 52 analysts collectively have a median consensus growth rate of over 20% for Azure.

FactSet Research Terminal

That is expected to drive cloud computing revenue from $75 billion last year to $221 billion in 2028.

That means MSFT’s overall sales are expected to more than double from $198 billion to $436 billion.

That alone is exciting and a reason to own Microsoft.

However, here is the growth kicker that is not yet backed into these estimates.

ChatGPT: Microsoft’s Secret Weapon

Statista

Launched publicly in November of 2022, ChatGPT has gone from no users to almost 2 billion within six months.

At its current growth rate, ChatGPT could reach 3.4 billion users by the end of 2023.

For context, the most actively used application in the world right now is the social media network owned by Meta, with 3.1 billion monthly users.

It took Meta 19 years to grow to 3.1 billion users, and ChatGPT could surpass that in one year.

- it’s already the fastest technological adoption product in human history

- taking the crown from crypto.

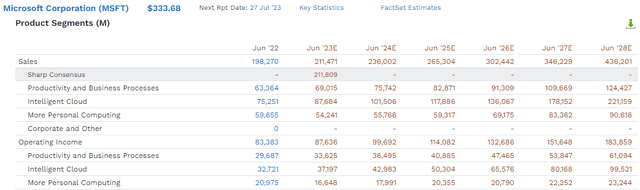

Daily Shot

Already 40% of Americans are using ChatGPT, and it’s only been seven months that it’s been available.

How do I know that ChatGPT is real and not another blockchain/crypto bubble?

As of March 2023, an estimated 8.3% of Americans own crypto, and that’s after 15 years.

In seven months, ChatGPT’s adoption has been 5X greater and in 1/26th the time.

Or, to put it another way, ChatGPT’s adoption rate is 130X greater than crypto.

Crypto = An 8 Foot Pontoon

AI is a 1,092 Foot Super Aircraft Carrier.

A supercarrier is literally 130X longer than a pontoon. And this is a good approximation of the difference between crypto and I.

One is a toy, and one is a war machine and tool of diplomacy so powerful it can wipe out entire countries.

Ok, so ChatGPT is powerful and popular, but why is it likely to be one of the top AI platforms in the future? After all, as of January 1st, 2023, there were over 300,000 AI chatbots online.

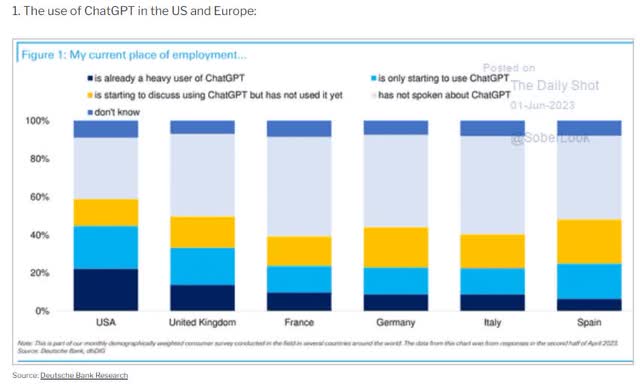

No One Is As Popular And Has Higher Satisfaction Than ChatGPT

Statista

And guess what? ChatGPT 5, which is likely to start training by the end of 2023 and launch in 2024, is likely to be even better.

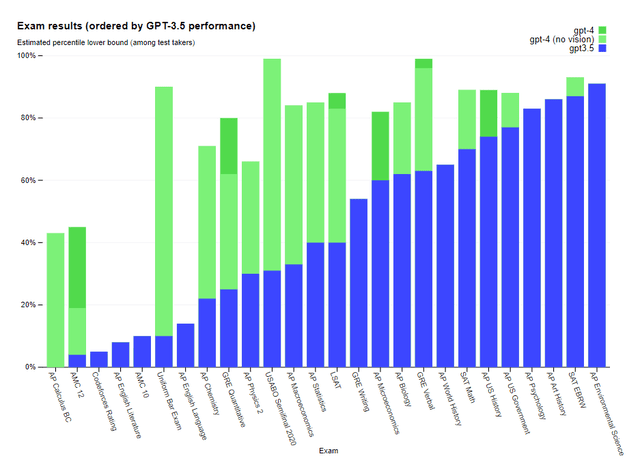

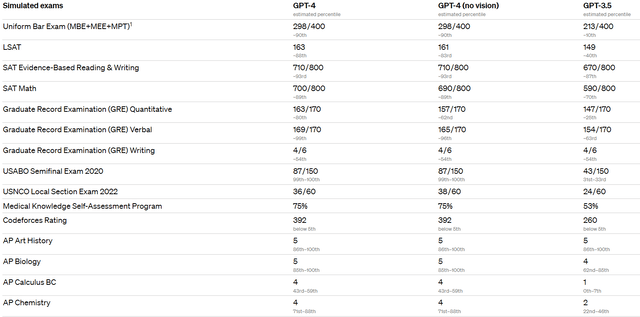

OpenAI

ChatGPT’s abilities and accuracy are improving at an impressive rate. Worried about safety? ChatGPT 4 is 80% less likely to hallucinate made-up information than ChatGPT 3.5, which most people use today.

- I pay $20 per month for ChatGPT Plus, so I can use ChatGPT 4.

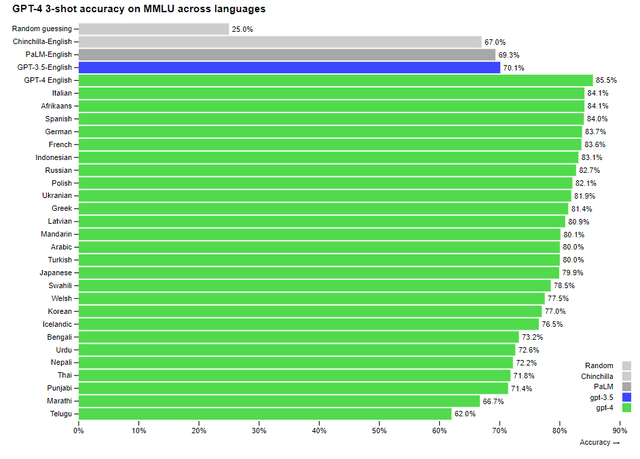

OpenAI

While still not doing well on written exams on science-based standardized tests, ChatGPT 4 is a champ.

OpenAI

ChatGPT’s accuracy might be 100%, but it’s better than anyone else’s product.

And while most of those are crappy and will never amount to anything, you have data titans like Meta and Google either working on or already promoting their own chatbots.

So to show you why ChatGPT, which is 33% owned by MSFT, is such a powerful potential growth tool, let me showcase a comparison between ChatGPT 4 and Google’s Bard.

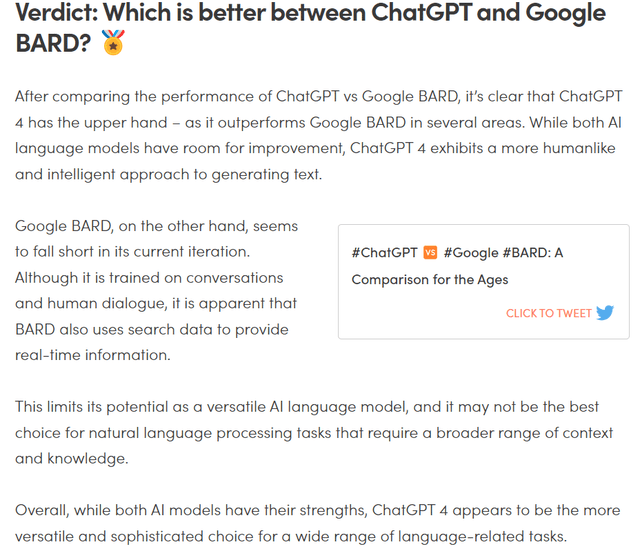

ChatGPT: Still The Gold Standard In Generative AI

ChatGPT is owned by OpenAI, which is 33% owned by MSFT.

However, for now, ChatGPT isn’t connected to the Internet. It’s manually trained on data from the internet.

- August 2021 cutoff for ChatGPT

- according to ChatGPT itself.

So you’d think that Bard, which is connected to the internet and has access to all of Google’s data from billions of daily users, would quickly become the most effective AI platform.

But you’d be wrong. At least for now.

NYT

Let me highlight just one example of how ChatGPT ran circles around Bard.

I started by telling ChatGPT and Bard that I was meeting with a potential investor next week. I randomly picked Scott Forstall, a well-known former Apple executive whose work history is publicly available on the web. I then asked the bots to do a background check on him and help compile talking points to persuade him to invest in my start-up.

ChatGPT did the job with aplomb…

it coached me on helpful strategies to win him over as an investor…

“Showcase how your start-up combines A.I. with other fields, such as cognitive psychology, linguistics or neuroscience, to create innovative solutions,” ChatGPT said. “This interdisciplinary approach may resonate with Scott, given his academic background in Symbolic Systems.” – NYT.

Now compare that to Bard’s answer.

In contrast, Bard gave a less detailed recap of Mr. Forstall’s work history without providing the years for when he made his career moves. Its advice for persuading him to become an investor was nonspecific. One talking point — “you have a strong business plan and a clear vision for the future of your company” — was particularly underwhelming.” – NYT.

And here’s what Scott Forstall himself said about the two AI-written pitches.

I shared the pitches with Mr. Forstall in an email. He called Bard’s response “comically generic” but said ChatGPT’s recommendations were “startlingly bespoke and cogent” as he had spoken at length about his ethical concerns over A.I.

“Overall, ChatGPT provides a compelling road map on how you could build a persuasive customized pitch deck specifically targeting me,” Mr. Forstall wrote. “Now that you have my attention, what exactly is your A.I. start-up?”- NYT (emphasis added).

So a leading Silicon Valley venture capitalist agrees that ChatGPT can do a VC pitch far better than Bard.

And in every other test, Brian Xen gave them, ChatGPT was the clear winner.

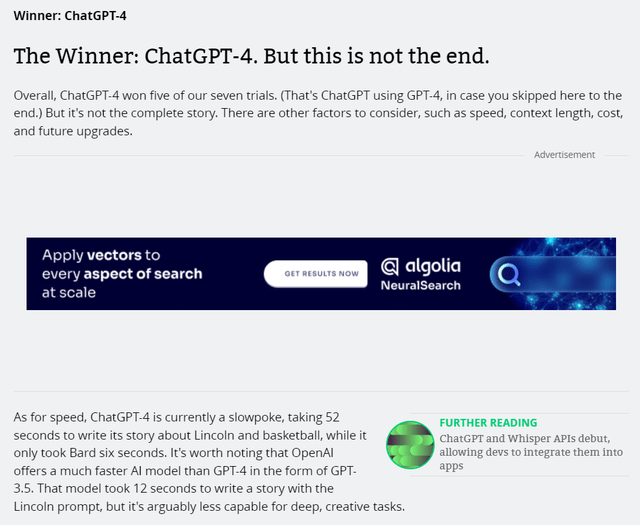

Ok, but that’s just one example of ChatGPT being better than Bard. And here are other head to heads.

Themisle

In this head-to-head, Bard wins 8-7.

Arstechnica

In this head-to-head, ChatGPT beat Bard 5-2.

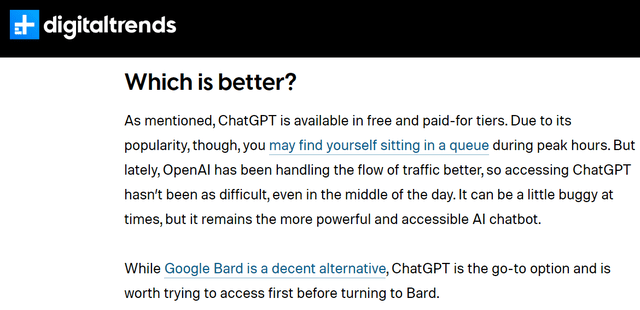

digital trends

And here is a head-to-head that finds Bard more user-friendly but ChatGPT superior in terms of actually getting work done.

Bard outperforms ChatGPT-4 when it comes to human-like response, user-friendliness of the interface, and real-time access to the internet. However, ChatGPT4 has an advantage in text-processing tasks like summarization and paragraph writing.” – Analytics Vidyha.

As mentioned in the introduction, these tests reveal clear strengths for each system. Suppose you want to accomplish verbal tasks, whether creative writing or inductive reasoning, try ChatGPT (and in particular, but not necessarily, GPT-4). If you’re looking for a chatbot to use as an interface with the web, to find sources and answer questions you might otherwise have turned to Google for, then head over to Bing. And if you are shorting Google’s stock and want to reassure yourself you’ve made the right choice, try Bard.” – The Verge (emphasis added).

TechCrunch agrees with the Verge.

There you have it. Overall, GPT-4 is unambiguously ahead of the others, though depending on the context, Claude and Bard can be competitive. Importantly, however, both Claude and Bard gave factually incorrect answers at times, and Bard even made up a citation to support its assertion about GDPR enforcement.” – TechCrunch.

So basically, ChatGPT started out with first mover advantage with ChatGPT 3.5 in November, padded its lead in March’s release of ChatGPT 4, and now we’re eagerly waiting for ChatGPT 5.

GPT-5 will follow in late 2023, according to some reports. It might turn out to be the most important ChatGPT update to date. But OpenAI said in mid-April 2023 that it’s not training the nex-gen model.” – BGR.

OpenAI said it wasn’t training GPT 5 yet in April and wasn’t planning to start soon.

Thus I would expect ChatGPT 5 to come out next year.

- annual upgrades, like what the iPhone does, seem reasonable for something this popular.

There are rumors that ChatGPT 5 will be true artificial general intelligence, allowing it to think and reason like a human.

I personally don’t expect that, but if OpenAI keeps improving the accuracy and safety of ChatGPT4 to a similar amount as 3.5 (5X fewer hallucinations, for example), that would be enough to stay ahead of Bard likely.

Microsoft Owns 33% Of Open AI And Should Buy The Rest… After The Prices Of AI Stocks Crash

MSFT spent $80 billion for Activision Blizzard, Inc. (ATVI) which was a fair deal, but will hardly move the company’s needle.

ATVI has $10 billion in sales, representing a 5% sales boost for MSFT.

ATVI is growing at 7% to 8%%, according to analysts, which is slower than MSFT’s 12% to 13%.

Now OpenAI isn’t going to be a money maker for Microsoft in the classical sense anytime soon.

Three sources briefed on OpenAI’s recent pitch to investors said the organization expects $200 million in revenue next year and $1 billion by 2024.” – Reuters

But remember that ChatGPT is the global leader in Generative AI, and Microsoft has the data and R&D chops to help take it to the next level.

Here’s how.

To sum it up in one sentence, ChatGPT is trained using Reinforcement Learning from Human Feedback (RLHF), a way of incorporating human feedback to improve a language model during training.” – TowardsDataScience (emphasis added).

The more people use ChatGPT, the better it becomes. There’s your network effect. Just like Google search gets better the more people use it, thus why it’s better than Bing and so dominant in search, ChatGPT is currently leading but Google hopes to use more up-to-date data, and a ton of it, to catch up and pass it.

Now imagine what happens if Microsoft plugs ChatGPT 4 into Azure.

Suddenly ChatGPT 5 can be trained on not just data from the internet (courtesy of Bing) but a lot more enterprise-style data.

Bard is good at sounding like a human.

ChatGPT is better at writing like a human.

ChatGPT trained with the help of Microsoft and fully integrated into Azure’s data analytics would potentially crank up the value proposition of Microsoft’s cloud offerings to 11.

Think of ChatGPT as the value kicker for enterprise cloud.

AWS or Azure, or Google Cloud? Who has the best AI analytics suite of products?

That’s the kind of thinking that will increasingly drive who companies choose for cloud computing, which can create unbeatable network effects.

The more data you have, your AI analytics and tools can improve.

So the more people use it.

Giving you even more data.

And thus making its advantage even stronger.

Microsoft paid a $30 billion valuation for OpenAI when it acquired 30% of the company in January.

At the moment, buying the rest of the company would cost a lot more.

- OpenAI should be racing to IPO in this AI tech bubble.

Valuations always matter, and “no price too high for AI” is not a sound investment strategy. So I’d like to imagine that MSFT is waiting for OpenAI’s valuation to crash along with the other AI stocks in the coming recession.

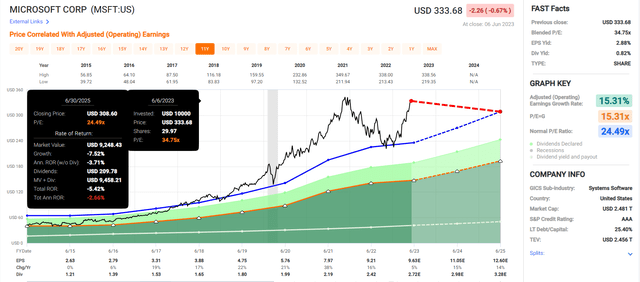

Valuation: Don’t Buy It Now But Be Ready To Back Up The Truck In The Coming Recession

Speaking of valuation, let’s consider Microsoft’s.

MSFT is up 37% YTD and clearly overvalued, as you can see.

FactSet, Fast Graphs

In the Satya Nadella era, MSFT’s market-determined fair value P/E is about 25 because that’s the average valuation over the past nine years.

Billions of cumulative investors have weighted the substance of MSFT, the good, bad, and ugly, the moat and management, the risk profile, and growth prospects.

| Metric | Historical Fair Value Multiples (11-Years, Nadella Era, New Business Model) | 2022 | 2023 | 2024 | 2025 | 2026 |

12-Month Forward Fair Value |

| Earnings | 24.49 | $227.27 | $252.49 | $290.45 | $345.06 | $389.88 | |

| Average | $227.27 | $252.49 | $290.45 | $345.06 | $389.88 | $269.28 | |

| Current Price | $327.65 | ||||||

|

Discount To Fair Value |

-44.17% | -29.77% | -12.81% | 5.05% | 15.96% | -21.68% | |

| Upside To Fair Value | -30.64% | -22.94% | -11.35% | 5.31% | 18.99% | -16.98% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $10.31 | $11.86 | $5.75 | $5.25 | $11.00 | 24.5 | 29.8 | 21.0 |

MSFT is trading at 30X forward earnings and 21X cash-adjusted earnings.

Even in the cloud computing era, it appears 21% historically overvalued and thus is pricing in all its expected growth over the next three years.

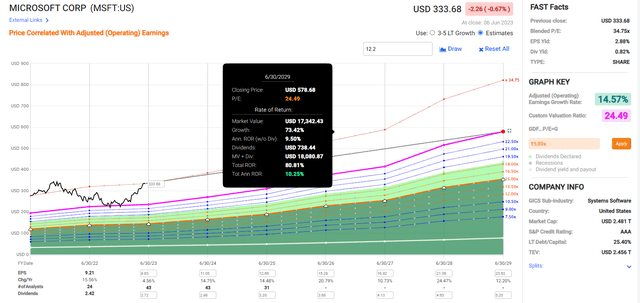

Microsoft 2029 Consensus Total Return Potential

FactSet, Fast Graphs

MSFT is growing strong enough that even overpaying by 21% could deliver solid double-digit returns over the next six years.

That’s about 50% better return potential than the S&P 500 consensus.

But look at what happens if you wait to buy MSFT at fair value in the coming bear market.

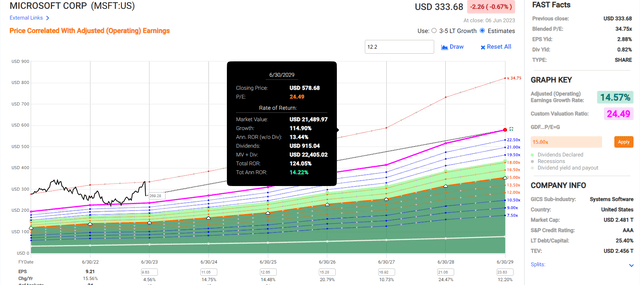

Microsoft 2029 Consensus Total Return Potential From Fair Value Of $269

FactSet, Fast Graphs

At fair value, MSFT’s consensus return potential rises from 80% over the next six years to 125%, and its annual return potential from 10% to 14%.

The long-term return potential is as follows.

- 1% yield + 12.2% growth = 13.2%.

That’s compared to a 12% long-term return potential for the Nasdaq and 10.2% for the S&P (not counting the AI productivity growth boost that AI is expected to deliver).

So far, the growth forecasts in MSFT don’t yet bake in the potential for AI, and if MSFT executes well on that front, then it potentially stands to benefit more than the average company.

For example, due to AI, Goldman thinks S&P earnings growth over the next decade might be 2.7% faster.

Even if MSFT merely matched that growth boost, it would boost MSFT’s growth outlook to 15% and 16% long-term returns if you buy at fair value.

- Most bearish analyst on MSFT: 10% long-term growth (KeyBanc)

- Most bullish analyst: 20% long-term growth (Wells Fargo)

- median consensus: 12.2%.

I wouldn’t expect AI to benefit MSFT more than 1% to 2% more than the S&P, but that still would potentially represent 16% to 17% long-term growth and a 17% to 18% long-term return.

I don’t mind making that kind of AI speculative investment for an AAA-rated, very low-risk Ultra SWAN and future dividend aristocrat.

Bottom Line: Microsoft Is Literally The Lowest Risk Way To Invest In The $1.3 Trillion AI Gold Rush

Here’s the bottom line about AI in general.

Many people are afraid of this new technology, and understandably so.

Those Americans aren’t wrong. AI is potentially the most powerful technology ever created.

It’s akin to nuclear power in the 1930s. It has the power to save the world or destroy it.

But here’s the thing. Hitler was racing to build an atomic bomb. So America had to build it first. If we lost that race, nothing else would matter because Hitler would have conquered Europe and possibly the entire world.

Today China, Russia, India, and North Korea, and many other hostile nations are racing to win the AI race.

Cyber security and, thus, infrastructure and financial security, and ultimately human life itself, is on the line. Not just that, but whoever owns AI’s future owns the global economy’s future.

Money is power, and the best AI is going to determine whether or not Democracy or dictatorship dominates the future of humanity. Not just for a few years, not even for a century.

The AI race is a race to determine whether liberty or tyranny will rule the earth for the rest of time.

According to Goldman Sachs, America is the most innovative country on earth. Home to the best universities, the largest and deepest capital markets, and the innovation hubs ranging from Silicon Valley to Boston’s biotech hubs.

- Dallas has been dubbed “silicon prairie.”

- Miami is working on becoming “the new silicon valley”

- and don’t forget about North Carolina “research triangle.”

America has the ability to win the AI race because our world-beater cloud giants have more and better data than our enemies.

We have the ability to do it safely and thus secure the future of liberty and democracy in the cyber age. Not just for the next century but the as long as humans exist.

It’s not just that AI offers the potential to end poverty around the world, by creating economic growth so robust that we end up living in a post-scarcity Star Trek utopia.

It’s not just that AI alone could solve the deficit problem that America and every developed country is currently facing (other than Denmark, Norway, Hong Kong, and Singapore).

It’s not just that AI-driven productivity growth could fuel long-term stock returns so strong that literally, anyone with an index fund could enjoy Buffett-like returns.

No one can deny the promise of AI, but the risks are real. If done wrong, AI could literally kill us all.

And even if it doesn’t, many Americans and workers in developed countries fear that they will be plunged into a permanent unemployment hellscape that might make them want to advocate for banning it entirely.

But even if you personally think that AI is mostly hype or that the downsides are greater than the upsides, remember that the race for AI is no less important than the race for the first atomic bomb.

Oppenheimer was the father of the atomic bomb and later regretted his role in building it.

Now I am become Death, the destroyer of worlds”. – Robert Oppenheimer, after the first atomic bomb detonation.

But I am glad that Oppenheimer and all the rest of the free world’s best nuclear scientists built it first. Because you and I are here today, debating the promises and perils of AI.

My parents are Polish. Had Hitler won the nuclear bomb race, he would have won the war, and I’d probably not be alive today to argue for the optimistic view that humans ultimately make the right decisions.

Technology can be dangerous. But the world has already crossed the Rubicon, and the AI genie is out of the bottle.

If America doesn’t lead in AI, then we risk literally being at the mercy of Vladimir Putin and President Xi of China.

I don’t know about you, but I’d rather take my chances with American Democracy and free markets figuring this complex stuff out than leave it in the hands of Russia, China, or any other global tyrant.

————————————————————————————-

Here’s the bottom line about why ChatGPT makes MSFT the ultimate “must own” world-beater blue-chip.

Warren Buffett defines fundamental investment risk as the risk of losing all your money, such as when a stock goes to zero in corporate bankruptcy.

Microsoft, the only U.S. company with three AAA-stable credit ratings (better than the U.S. Treasury), is literally the lowest-risk company you can own by that definition.

The reason I like Microsoft as a long-term “AI play” is that even if the AI hype proves to be as overblown as “blockchain is the next Internet” or “meta verse is the next internet,” you still own Microsoft.

This AAA-rated future aristocrat is growing at 12% to 13% long-term and offers long-term return potential superior to the S&P 500, Nasdaq, and the dividend aristocrats.

S&P literally thinks the U.S. government is more likely to collapse in the next 30 years than Microsoft.

But the true “hidden upside” to Microsoft is its 33% ownership of OpenAI.

Technically, Alphabet’s Bard has access to more data…for now.

But as we’ve seen, more data doesn’t necessarily mean that an AI platform can instantly become #1 in effectiveness or popularity.

No, I’m not saying that ChatGPT is going to turn Bing into a “Google killer.” The data clearly says that’s not happening, at least not right now.

I am saying that if Microsoft were to plug ChatGPT’s large language model into Azure and give it real-time access to internet through Bing, then ChatGPT 5, 6, and 7 could be developed faster.

And if MSFT buys OpenAI (after AI stocks crash in the coming recession so it’s not paying an absurd valuation), then it would be able not just to improve ChatGPT’s functionality at an exponentially faster past it could integrate that amazing functionality into Azure.

The value of Azure’s data analytics would be improved to an almost unimaginable degree.

Cloud computing effectively outsources data and some corporate IT.

But with ChatGPT 5 integrated into Azure, Microsoft could suddenly offer a one-stop-shop that outsources almost every part of a business.

The best algorithms are the key to the best AI functionality, which requires data. And MSFT, through its #2 position in cloud computing, has access to more data than almost any company on other earth.

Microsoft has an R&D budget of $28 billion per year which is expected to almost double to $55 billion by 2028.

Microsoft’s R&D budget is made possible by $89 billion in annual operating cash flow, that’s expected to grow to $200 billion by 2028.

Microsoft’s free cash flow is expected to be $60 billion in 2023 and grow to $140 billion by 2028.

So even if it turns out that all of us are “drinking the AI koolaid” and overestimating how world-changing this technology is, you still own one heck of a company.

Basically, Microsoft Corporation is a wonderful company and as close to a “must-own” world-beater as can ever exist on Wall Street. If bought at a fair price, it could ensure a safe and prosperous retirement all on its own.

And if Goldman and Bloomberg and all the other AI-bullish experts are right? Then Microsoft is likely to be one of the 3 data titans that own the future of generative AI and, thus, the future of the entire global economy.

Or, to put it another way, whoever owns the future of data, owns the future of AI, and whoever owns the future of AI owns the future of the economy and, thus, the future of money itself.

Microsoft is one of the three best-positioned companies in the world to dominate AI…but remember, “No price too high for AI” is a philosophy that will not age well. 😉

[ad_2]

Source link