[ad_1]

Anton Vierietin

The Intel Investment Thesis Has Further Eroded

Intel (NASDAQ:INTC) may finally be near the end of its reign in the semiconductor chips market, with the inevitable transition to generative AI.

The latest quarter earnings results are already telling of the cadence, with its data center revenues eroding to $3.7B (-39.3% QoQ/ -13.9% YoY), with Advanced Micro Devices (AMD) similarly impacted with revenues of $1.29B (-21.8% QoQ/ inline YoY).

Well then, the winner is obviously Nvidia Corporation (NVDA), which grows its market share tremendously with data center revenue of $4.28B (+18.2% QoQ/ +14.1% YoY) by the latest quarter.

In this age of intense competition, it is apparent that no tech companies want to adopt a less popular product, with most flocking to the perceived AI chip market leader, as visible in NVDA’s mind-blowing forward guidance of $11B (+52.9% QoQ/ +64.1% YoY) for the next quarter, well exceeding the consensus estimates by +54.7%.

Much of this cadence is attributed to the redesign of data centers toward accelerated generative computing, which requires a lot more GPUs and software than conventional servers, as highlighted by Jensen Huang, the CEO of NVDA:

The data center of the past, which was largely CPUs for file retrieval, is going to be, in the future, generative data… So instead of millions of CPUs, you’ll have a lot fewer CPUs, but they will be connected to millions of GPUs… You have to engineer all of the software and all of the libraries and all of the algorithms, integrate them into and optimize the frameworks, and optimize it for the architecture, not just one chip but the architecture of an entire data center. (CNBC)

Assuming that this cadence continues, we will not be surprised to see more demand erosion from INTC, which has been struggling to produce competitive products, much less market-leading chips.

While our previous INTC article has highlighted some of its promising prospects from the partnership with NVDA, we have also concluded that its offerings may not stem the losses in market share thus far, due to the intense competition similarly offered by its peers.

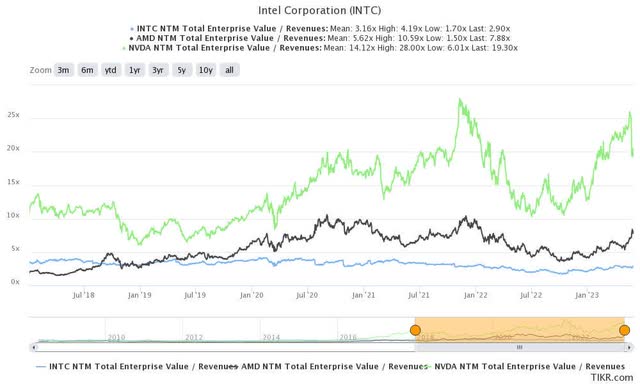

INTC 5Y EV/Revenue

S&P Capital IQ

The same pessimism is already embedded in INTC’s valuations, with NTM EV/ Revenues of 2.90x, lower compared to its 5Y mean of 3.16x. Its peers are notably doing better, with AMD recording NTM EV/ Revenues of 7.88x and NVDA at 19.30x, against their 5Y mean of 5.62x and 14.12x, respectively.

This cadence alone reflects Mr. Market’s uncertainty about INTC’s demand recovery, with NVDA already eating the former’s lunch in the discrete GPU market by Q4’22 (Q1’23 data not available yet). Furthermore, AMD is not standing by the sidelines, with the latter gaining more share in the x86 CPU market to 34.6% by Q1’23 (+3.3 points QoQ/ +6.9 YoY).

This is on top of the competition offered by NVDA’s recent CPU super chip, Grace, potentially triggering a massive monopoly in the CPU and GPU market ahead, likely to overtake INTC’s Sapphire Rapids and Emerald Rapids in 2023. While the latter expects to release Granite Rapids and Sierra Forest in 2024, it also remains to be seen how these may perform against AMD’s Zen 5 architecture to be released by the end of 2023.

With INTC losing both market edge on the left and market share on the right, it is likely that its offerings may be relegated to the third rank, similarly triggering a moderation in its pricing strategy and margins ahead.

With the chip company moderating its Research & Development efforts to $4.1B by the latest quarter (-8% QoQ/ -5.9% YoY), as NVDA ramps up to $1.86B (-4.6% QoQ/ +16.2% YoY) and AMD to $1.41B (+3.6% QoQ/ +33% YoY), we fear that INTC may be near “from becoming food” after all, as highlighted by Jensen Huang, the CEO of NVDA, in the graduation ceremony of National Taiwan University:

Whatever it is, run after it like we did. Run. Don’t walk. Remember, either you are running for food; or you are running from becoming food. And often times, you can’t tell which. Either way, run. (Nvidia)

While the INTC bulls may still argue for the company, we are increasingly bearish on its forward prospects in the x86 market, accelerated cloud computing, machine learning, and foundry ambitions. Its legacy will have to contend with many other motivated and competent competitors looking to produce cutting-edge CPUs, PC GPUs, discrete GPUs, and ML/AI chips, including:

- AMD and NVDA.

- other Big Techs, such as Microsoft (MSFT), Google (GOOG, GOOGL), Amazon (AMZN), and Meta (META).

- established foundries, such as Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung (OTCPK:SSNLF).

As of now, INTC’s strategy appears to result in a jack of all trades and a master of none. This is not a convincing investment thesis, in our opinion.

So, Is INTC Stock A Buy, Sell, or Hold?

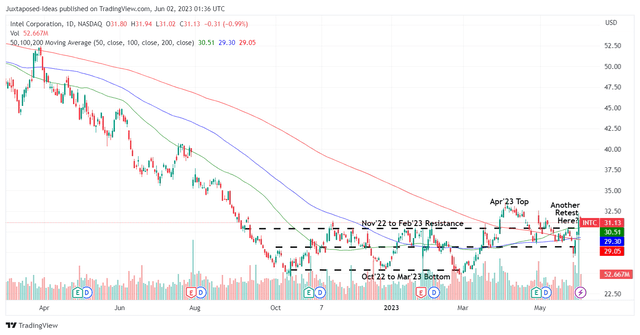

INTC 1Y Stock Price

Trading View

Despite the overwhelming pessimism discussed above, INTC continues to trade sideways, suggesting the immense support the stock enjoys here. This is despite the massive dividend cut announced in February 2023, one which may have decimated other lesser stocks.

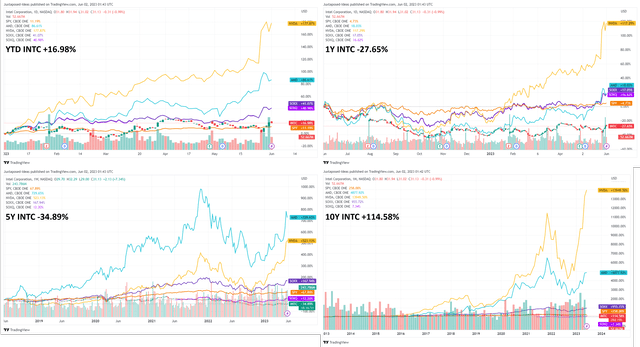

INTC’s Total Returns Including Dividends

Trading View

Then again, we are not certain if it is a good idea to add INTC here. While past performance may not be a good indication of future results, the stock has underperformed against its peers, the semiconductor ETF, and the wider market for the past few years.

With the dividend cut, the stock is no longer a viable income stock as well, boasting a mere forward dividend yield of 1.59%, compared to its historical 4Y cadence of 3.06% and sector median of 1.47%. As a result of the underperformance, we are massively underwater for our INTC investment, with us likely to reallocate the capital to other endeavors if an opportune time comes.

Meanwhile, we are rating the INTC stock as a Hold for now, since we prefer not to realize losses at these depressed levels.

[ad_2]

Source link