[ad_1]

sefa ozel

In July 2021, I released an article arguing that stocks, in particular, growth stocks are unreasonably overvalued and are due to crash as a result of high inflation and a consequent raise in interest rates. Fast forward, nearly all the mentioned names are down 50% or more. However, I am not revisiting old predictions and praising myself, as predicting a crash in a stock trading at over 40 times Price to Sales is not a big accomplishment.

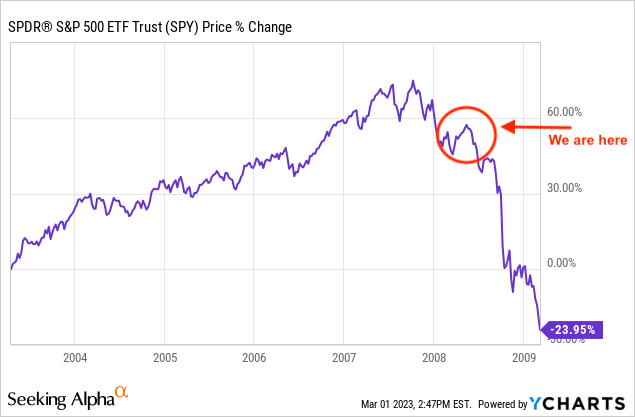

Instead, I was mostly wrong, since I expected the broader market, including large caps that represent the backbone of the economy to crash as well. However, the market has only contracted roughly 5% since that article, whilst many companies reached new all-time highs as a result of reporting record profits. That said, while the market crashed some 25% since its all-time highs in October, it has rebounded steadily since, as a result of better-than-feared earnings, and cooling inflation in some sectors. However, as inflation continues to stay elevated, the Federal Reserve will have little room to cut rates in the foreseeable future. As inflation depletes consumers purchasing power, large companies that fared relatively well will see earnings fall sharply in coming quarters. It is, therefore, not unreasonable to expect a 30% crash in the S&P 500 and a 20% crash in global equities such as MSCI World Index.

Valuations Remain High

The swift opening of the global economy, following the Covid pandemic, coupled with high consumer savings and global shortages, has led to the highest inflation seen in over 40 years. As a result, the federal reserve raised interest rates to the highest since October 2007, following a decade of low-interest rates. While the increase in inflation and interest rates certainly hurt the valuations of high-growth companies and highly in-debt firms, it did not meaningfully affect pro-cyclical stocks.

In fact, quite the opposite has been the case so far. Here, energy companies have recorded record profits due to the surge in oil prices. Besides energy companies, sectors such as commodities, agricultural, financial, and consumer staples have been seen benefitting from inflation and growing their earnings in line with, or even above inflation rates. Major large caps, such as Exxon Mobil (XOM), Booking Holdings (NASDAQ:BKNG), Caterpillar (NYSE:CAT) and Morgan Stanley (NYSE:MS) are up double-digit percentages year-over-year, despite the broader market sell-off. These and many other companies have held up the overall index and prevented an overall recession, due to the distribution of profits to other industries. That said, even companies in the technology sector fared relatively well. For instance, tech giant Microsoft (NASDAQ:MSFT) continued to grow revenues in its last quarter, while Apple (NASDAQ:AAPL) only saw a small decrease in revenues after record revenue growth during the pandemic.

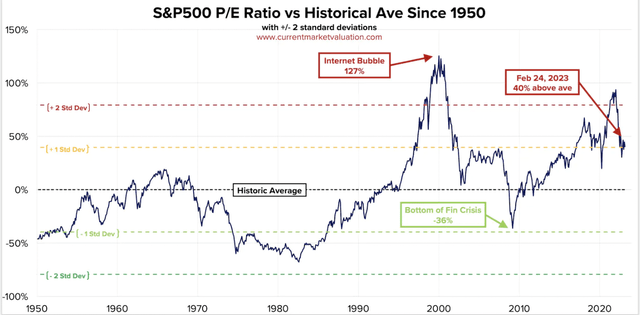

Historic Price to Earnings Ratio – S&P 500 (Current Market Valuation)

Nevertheless, companies that benefited from the high inflationary environment also saw their valuations expand faster than their actual earnings growth. Take Caterpillar for example, which now trades at 23 times Price to Free Cash Flow, compared to its historical average of around 13 times. The same applies to Energy companies that currently trade at the same or higher earnings multiples than before inflation took off.

However, the main thesis of the current market rebound is based on the assumption that energy prices will drop, and in turn, cool inflation, allowing the Fed to steadily lower rates again. However, in that case, the above-mentioned ‘winners’ should see earnings fall alongside their valuations. If energy and commodity prices do not cool and inflation stays high, the Fed will need to hold interest rates up, or even increase them, which in turn will further drain liquidity from the markets and lower valuations.

In the second option, even pro-cyclical stocks will see earnings fall, similar to 2008, as demand will dry up accordingly. Personal savings have already dropped significantly, as inflation has outpaced real wages of the lower and middle classes, which make up the largest portions of the GDP. However, as prices for basic goods have been surging lately, the typical middle class is being placed at increased risk of losing its wealth and purchasing power. As savings dry up, millions at the border between Upper and Lower income levels will decrease consumption, simply due to affordability.

This will affect luxury goods, such as travel, but could also affect certain price segments of necessities. Yet, despite an almost imminent drop in these goods and services, companies within these sectors are priced at record valuations.

Compiled by Author

Now, the case I am trying to make is that the current valuation of both cyclical and non-cyclical stocks just does not reflect and price in current risks. That said, the average P/E ratio of all companies within the S&P 500 index currently stands at roughly 28.3, which is 40% higher than the historic average of 19.6. The current earnings ratio translates to a yield of 3.5%. However, the current interest rate stands at 4.57%, which does not seem like a lot, yet it translates to a 30% difference. It should be noted that the latter also comes with a risk premium of zero, whilst stocks face decreasing earnings in a looming recession.

Part of that discrepancy is likely partially tied to expectations of soon-approaching rate cuts, in which case the above-mentioned difference levels out. However, drastic interest rate cuts are not to be expected unless inflation drastically decreases. As shown by the latest data from both the Eurozone and the U.S. shows, inflation remains resilient and places pressure on central banks to even further increase rates.

If upcoming data shows the economy moderating and inflation slowing, Waller said he would “endorse” the target federal funds rate rising to roughly the same spot policymakers projected as of December, when 13 of 19 officials saw rates coming to rest somewhere from 5.1% to 5.4%. – Reuters

In January, inflation in the U.S. came in at 6.4%, and while this is lower than the 6.5% recorded in December, it is still far from the FED’s target of 2%. Early in February, data showed that the consumer price index in January cooled less than economists had expected. Moreover, the U.S jobs report at the beginning of February showed that half a million workers had been hired in January, almost three times what economists had predicted. Meanwhile, the inflation situation in Europe looks even more concerning, with inflation in France and Spain unexpectedly accelerating and increasing to 9.3% from 9.2% in January in the rest of the EU zone.

Investors will now be focusing on the next job report which is due to be reported on March 10, ahead of the FOMC February meeting on March 21-22, where the Fed is expected to raise rates by another 0.25 basis points.

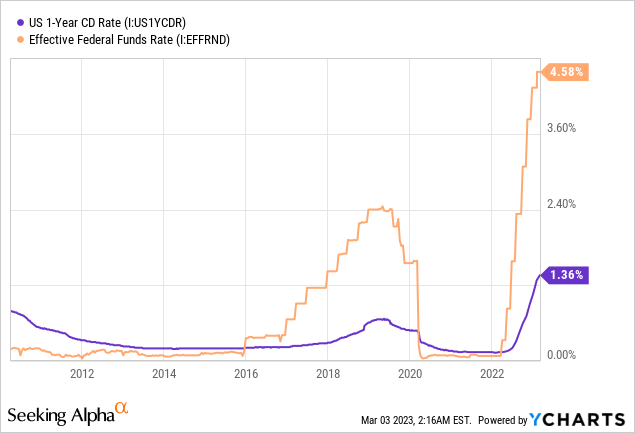

However, as mentioned, stocks are currently priced for swift monetary easing. If, however, the opposite is the case, stocks will broadly drop 20-30% within weeks, whereas the upside is already priced in. As of right now, investors are staying invested in equities to counteract the deteriorating value of cash, despite carrying more risks. This makes sense, as current savings accounts offer a mere 1-2% in annual interest, far less than current inflation.

However, once banks increase their interest on savings to say 4-5% annually and government bonds jump to 7%, the market will face unprecedented outflows, leading to massive valuation cuts.

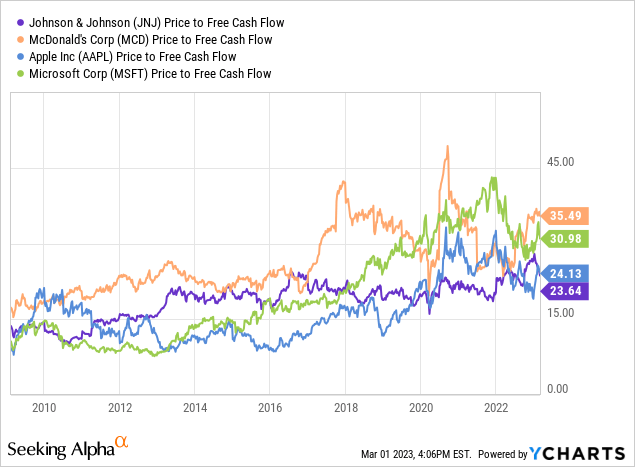

Y-Charts (compiled by author)

The S&P 500 and arguably even the MSCI World Index are both relatively concentrated in a few mega-cap stocks that saw their valuations expand drastically over the last decade. For example, Apple expanded its valuation from its low in 2013 at 7 times Price to Free Cash flow more than threefold to over 24 times as of right now. This is despite uncertain economic conditions and much higher interest rates. If a broad recession strikes, a company in the luxury segment like Apple will likely be affected first and most severely; yet, somehow, its valuation suggests differently.

The same applies to Microsoft, which has seen its valuation grow from just 8 times its annual operating free cash flow to over 30 times as of today. The question is if investors will continue to invest or be invested in a company offering a 3.5% yield when they can get a 6% yield on risk-free bonds. However, it is not just the index heavyweights that have inflated massively over the past decade. Pharmaceutical giant Johnson & Johnson (NYSE:JNJ) more than doubled its trailing 12-month P/E ratio since 2011. The same applies to McDonald’s (NYSE:MCD), Nike (NYSE:NKE), and many more. Even if a recession does not occur and earnings don’t fall, a pure valuation reset could drag the index down 30% or more.

Paradoxical Rebound in Growth Stocks

However, not only defensive and highly profitable companies have been rebounding since October. High-growth stocks, particularly technology stocks have been surging by up to 100% after being crushed throughout most of 2022. This is surprising, considering that many Tech stocks have faced slowing growth amid a reopening of the economy and lower capital accessibility to fund growth. As a result, the industry faced a tsunami of layoffs which continue to this date.

In notes to laid-off employees and investors, the companies blamed an economic downturn and reduced customer spending for the decision. However, this didn’t seem to scare off tech investors too much, as the future for revolutionary technologies like AI seems bright. In the spotlight of this revolution stands the artificial intelligence chatbot ChatGPT, which is able to respond to text-based queries and generate automated language responses.

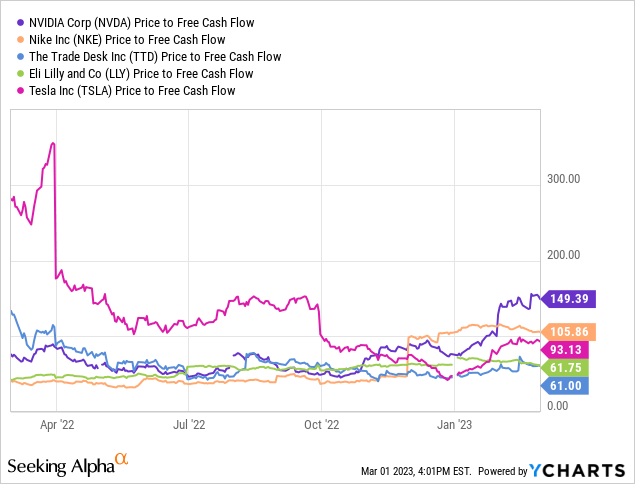

The ChatGPT craze spread to a larger crowd of forgotten tech stars like C3.ai (NASDAQ:AI), Shopify (NYSE:SHOP), monday.com (NASDAQ:MNDY), and others. While some of these names continue to grow revenues, their valuations are simply unjustified, despite already contracting from all-time highs in 2021. Nvidia (NASDAQ:NVDA) for example, reported a 20% drop in revenues and a 58% drop in operating income in its last earnings call, yet the stock is up over 100% since its year-lows and is slowly approaching all-time highs once again. It seemed once growth slows, that Nvidia would be valued based on its earnings, yet at over 100 times operating free cash flow this does not seem to be the case.

Meanwhile, ‘traditional’ chip manufacturers such as Intel (NASDAQ:INTC) are valued at one-tenth of their valuations, as they apparently got nothing to do with AI. Thus, while I do believe that many of these companies have a proven and innovative business model, the valuations could easily shed 60-80% and drag down major indexes such as the NASDAQ 100 (QQQ).

Where to Hide Out

As the economy faces a potential recession, overvalued equities face significant downside. So investors may look for alternative investment opportunities to counteract inflation. After all, plain cash will lose its value quickly if inflation continues at the same rate. It should be mentioned that just like during every market phase, there are stocks that prove to be a safe haven. For instance, the healthcare and pharmaceutical sector proves to be relatively resilient to economic downturns and geopolitical conflicts. Here, major pharmaceuticals such as Pfizer (NYSE:PFE) trade at below 10 times Price to Earnings and demonstrate a robust balance sheet. As always, investors need to position their portfolios based on personal risk profiles and given timeframes. If the timeframe is short to medium-term, it may be best to wait in order to receive a more favorable entry point.

[ad_2]

Source link