[ad_1]

da-kuk

Palantir’s (NYSE:PLTR) business is fundamentally on a positive trajectory as the software analytics company guided for GAAP profitability in FY 2023. Palantir delivered a strong earnings sheet for its first fiscal quarter and said that it plans to achieve GAAP profitability in every single quarter this year. For this reason, I have argued that Palantir was at an important inflection point that could result in continual upwards share price momentum. Additionally, I want to expand on Palantir’s extraordinary opportunity in the artificial intelligence market as it creates a new frontier of growth for the software company in the coming years.

Palantir: AI Is The Next Frontier

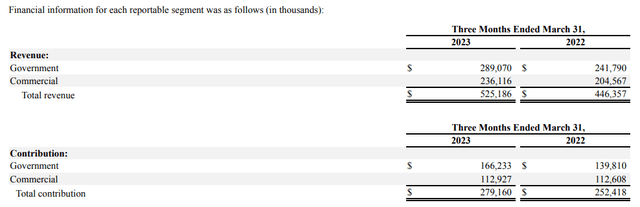

Palantir’s commercial business has grown out of its foundational government business. What separates Palantir from other software vendors is that the company has deep relationships with various government agencies, especially regarding national security, defense and law enforcement. The government business generated well above 50% of revenues for Palantir in the past, but this has changed in the last few quarters as Palantir made a concerted effort to accelerate growth in its commercial segment. In the most recent quarter, Q1’23, the government segment accounted for 55% of total revenues as opposed to a revenue share of 61% in Q1’21.

Source: Palantir

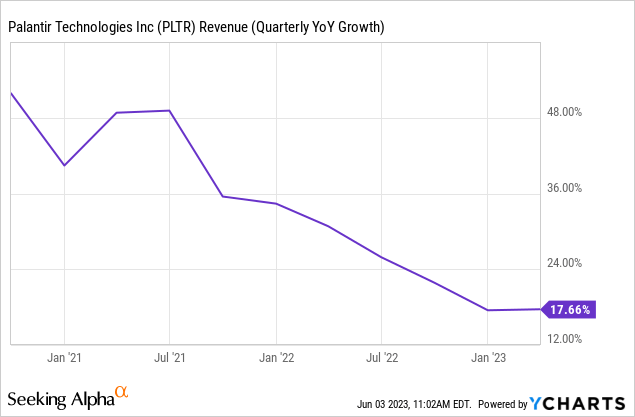

Palantir’s growth, especially in the commercial segment, has been a key reason for investors to buy into the software company in recent years. However, I believe that Palantir could see a strong performance in its core government business, due to adoption of artificial intelligence solutions, especially in the military realm. Palantir’s growth slowed to 18% in the last quarter, but the company could see a re-acceleration of its growth if its clients start to broadly adopt artificial intelligence applications.

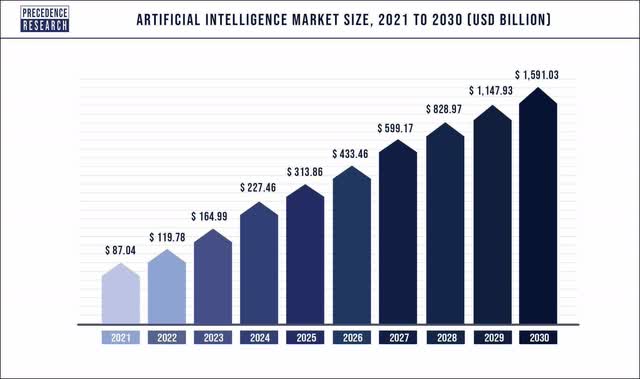

The development of ChatGPT is looking to be a game-changer for many industries as advancements in the artificial intelligence realm are set to uproot many industries. As a result, the artificial intelligence market is set for explosive growth over the next decade which also represents an enormous opportunity for Palantir which could easily deploy AI solutions in its software package. Palantir’s core Foundry business, as an example, helps government institutions and corporations to sift through mountains of data, make aggregations and do important analysis work. Artificial intelligence applications could be used to derive analytical insights from large data sets, resulting in potentially faster and cost-optimized decision making.

According to Precedence Research, the artificial intelligence market is set to increase by a factor of 18X between FY 2021 and FY 2030, to a market volume of $1.6T. These estimates may prove to be conservative as the AI industry is going through a rapid phase of technological progress at the moment. This progress has been reflected, as an example, in soaring demand for Nvidia’s (NVDA) artificial intelligence chips.

Source: Precedence Research

Palantir has strong growth potential in AI sub-markets

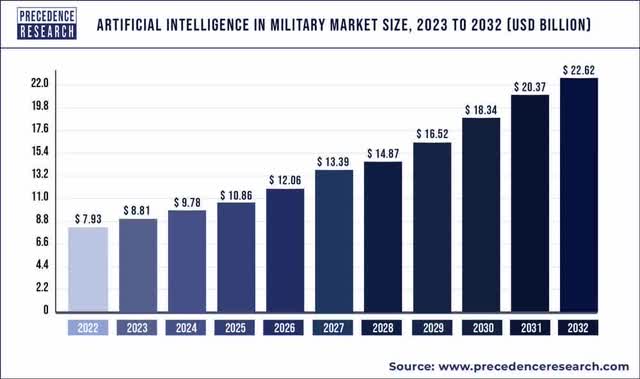

Like any market, the AI market can be divided into many different sub-markets. Given Palantir’s strong government business, the software firm faces an enormous market opportunity when it comes to military-oriented artificial intelligence applications. Artificial intelligence is set to have a huge impact on the U.S. military as artificial intelligence can enhance intelligence gathering, data collection and decision making.

Palantir’s AIP could, as an example, be used by the U.S. military to create a real-time representation of the battlefield, thereby given U.S. troops a tactical advantage over the adversary. While Palantir has said that a lot of defense work is classified, it is not difficult to imagine different scenarios in which AI could be used in a military context. AI could be used to deliver efficiencies in military logistics, analyze surveillance data or power drone fleets, thereby reducing the demand for personnel. Palantir’s CEO Alexander Karp has said in a recent interview that AI is driving interest in the firm’s software products. Palantir’s AIP also focuses on providing security for large language models which is a key interest for both the U.S. military as well as the commercial sector.

Also according to Precedence Research, the artificial intelligence opportunity in the military market is phenomenal as spending on AI products is just about to ramp up. The artificial intelligence military market is expected to grow to $22.6B over the next decade, showing a potential factor increase of 2.9X compared to the base year 2022. Of course, actually realized growth rates could be significantly higher and the market size could balloon into a much larger figure as the AI revolution is just at its beginning.

Source: Precedence Research

One way to capture this potential is for Palantir to roll out and aggressively scale Palantir AIP… which is the company’s Artificial Intelligence Platform. This platform could complement the firm’s foundational Foundry offerings which are already deployed at scale. Therefore, I believe artificial intelligence adoption could be an accelerant for Palantir’s existing core analytics business as the company has an opportunity to leverage its existing software platforms to integrate machine learning capabilities.

Palantir’s valuation

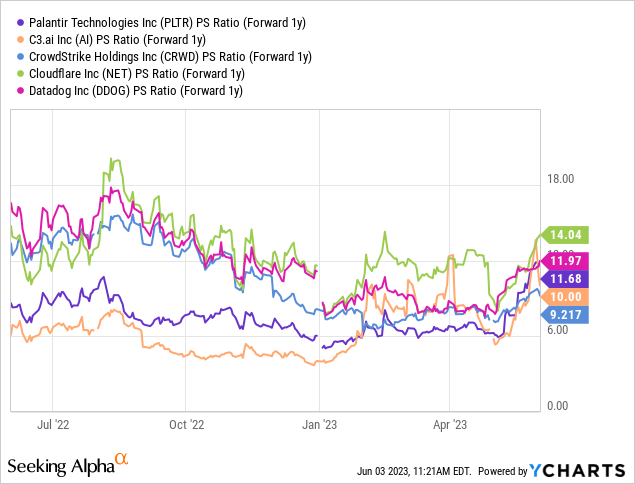

Palantir has seen a strong upwards revaluation of its shares after the company’s first-quarter earnings, but I believe Palantir has a lot more gas in the tank, especially because many companies will be forced to deal with the impact of the AI revolution and accept that artificial intelligence is going to revolutionize every industry there is.

In that sense, it may me more useful to compare Palantir to cloud-based software/AI companies like C3.ai (AI)… or like a cloud-security company such as CrowdStrike (CRWD), Cloudflare (NET) or Datadog (DDOG). Palantir is currently trading at a P/S ratio of 11.7X, which isn’t really that much out of the ordinary. If Palantir moves aggressively into the Cloud/AI market, which I believe it will, then Palantir could also see a reacceleration of its top line growth.

Risks with Palantir

Palantir has been extensively criticized in the past for its slowing top line growth and the lack of profitability. Since the software analytics company has already guided for GAAP profitability this year, I believe the company will be less vulnerable to this criticism going forward. Top line growth has slowed as well in recent quarters, but AI provides Palantir with an enormous growth opportunity. What would change my mind about Palantir failed to capitalize on the opportunity in artificial intelligence and failed to reinvigorate its revenue growth.

Final thoughts

Palantir and the ascent of AI are a match made in heaven: the combination of Palantir’s existing government (military) business with the firm’s Artificial Intelligence Platform could be an accelerant for Palantir’s top line growth in the coming years… the potential of which is not yet reflected in the company’s valuation. The market size for artificial intelligence applications is rapidly expanding and Palantir is in a unique position to capitalize on this growth through integration of machine learning solutions into its already deployed Foundry platforms. As a result, I believe there is a chance for Palantir to see a re-acceleration of its top line growth, especially in the government business, going forward!

[ad_2]

Source link