[ad_1]

Nvidia (NVDA 2.54%) dazzled the stock market on Wednesday, posting better-than-expected results in its first-quarter earnings report and offering eye-popping guidance for the second quarter. Shares finished the aftermarket session nearly 25% higher, adding close to $200 billion in market value.

The world’s most valuable semiconductor company actually reported a year-over-year decline in revenue, which was expected as it faces difficult comparisons in its gaming segment. However, all eyes were on the data center segment. This area reflects the surging demand for artificial intelligence (AI) chips, which has skyrocketed since ChatGPT’s launch late last year. Here, Nvidia did not disappoint.

Data center revenue rose 14% from the previous year and 18% from the previous quarter to a record $4.28 billion, and Nvidia’s management forecast accelerating demand for AI capabilities.

CEO Jensen Huang said, “A trillion dollars of installed global data center infrastructure will transition from general-purpose to accelerated computing as companies race to apply generative AI into every product, service, and business process.”

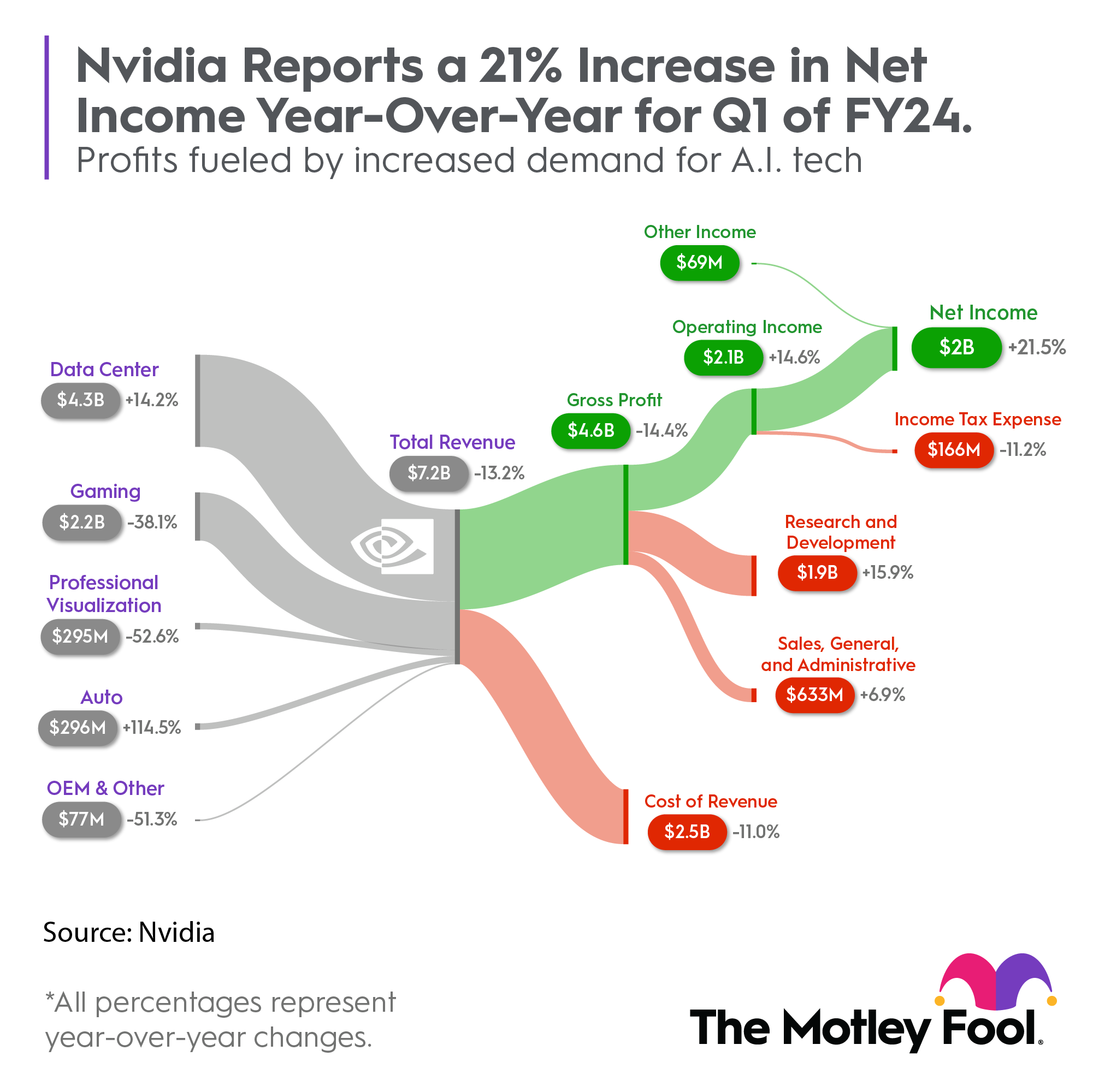

The chart below shows how Nvidia’s results broke down in the quarter.

Even better than the first-quarter results was the company’s guidance.

Nvidia called for $11 billion in revenue in the second quarter, up 64% from the quarter a year ago and up 53% from the first quarter, a dramatic acceleration after a year-over-year decline in revenue in the first quarter. On the earnings call, management said that the data center segment and demand for AI would drive the bulk of that growth.

The ripple effect

Nvidia’s results and guidance were impressive enough that other AI stocks also gained on the news.

C3.ai (AI 15.95%), for example, finished the after-hours session up 8.2% as investors have bid the enterprise platform for AI higher this year even though its results have been disappointing.

Fellow chipmaker Advanced Micro Devices (AMD 5.55%) also popped 8.2% after hours. AMD is seen as a beneficiary from the boom in AI chip demand, but its graphics processing units (GPUs) are generally considered to be less powerful than Nvidia’s.

By comparison, AMD’s data center revenue was flat in the quarter and was just a fraction of Nvidia’s at $1.3 billion.

Since C3.ai and AMD have already reported results for their most recent quarters, the direct implications of Nvidia’s results seem minimal for those two stocks, but the top chipmaker’s coattails are strong enough to give these stocks a significant boost.

In fact, all three have been big winners so far this year with Nvidia and C3.ai up about 150% and AMD gaining 67%.

A picks-and-shovels approach to the AI gold rush

There’s been plenty of investor excitement over artificial intelligence this year, but it’s only been six months since ChatGPT launched. Competition, including between heavyweights like Microsoft and Alphabet, is intensifying, and investors should be wary of the gold rush as past tech booms like the dot-com bubble, 3D printers, electric vehicles, and even cloud computing led to significant collapses in stock prices.

However, NVIDIA offers a way to get exposure to the AI revolution that no other stock does. Rather than trying to pick the winner in the AI chatbot wars, or bet on an unproven company like C3.ai, investors can buy shares of Nvidia and own a stock that looks set to gain from AI no matter what happens, as long as demand for AI chips continues to rise.

This is the picks-and-shovels approach, and much like picks and shovels represented essential tools for the gold rush, so do Nvidias’s chips for the AI revolution now. As CFO Colette Kress said in a prepared commentary, growth in the data center business “reflects strong demand from large consumer internet companies and cloud service providers.” In other words, the world’s biggest tech companies are counting on Nvidia to facilitate their AI transitions.

Nvidia stock is expensive, but the first-quarter results show that Wall Street is still underestimating its potential in the AI boom. It’s the leading chipmaker for generative AI, and that position is unlikely to change as the company continues to innovate with new products like its Hopper GPU architecture.

While the AI hype is inflating other stocks, Nvidia has a dominant market share in high-value AI chips, and it stands to benefit no matter which generative AI products emerge victorious.

In my assessment, this is the only AI stock you need to own right now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

[ad_2]

Source link